Who Makes the Most Money Per Bike? A Global Comparison of Motorcycle Brands

By Rafael Benavente

🏍️

Who Makes the Most Money Per Bike? A Global Comparison of Motorcycle Brands

In the world of motorcycles, success isn't just about how many bikes you sell—it's about how much profit you make on each one. While brands like Honda and Royal Enfield dominate global sales volumes, they don’t necessarily lead in profit per unit. That title belongs to a very different class of manufacturers. Let’s break down which motorcycle companies are the most profitable per bike based on estimated operating income per unit sold in 2024.

💸 What Is Operating Income Per Bike?

Operating income per bike measures how much profit a company makes before interest and taxes for each motorcycle sold. This gives us a clearer picture of business efficiency and pricing power—and filters out volume noise to focus on margin.

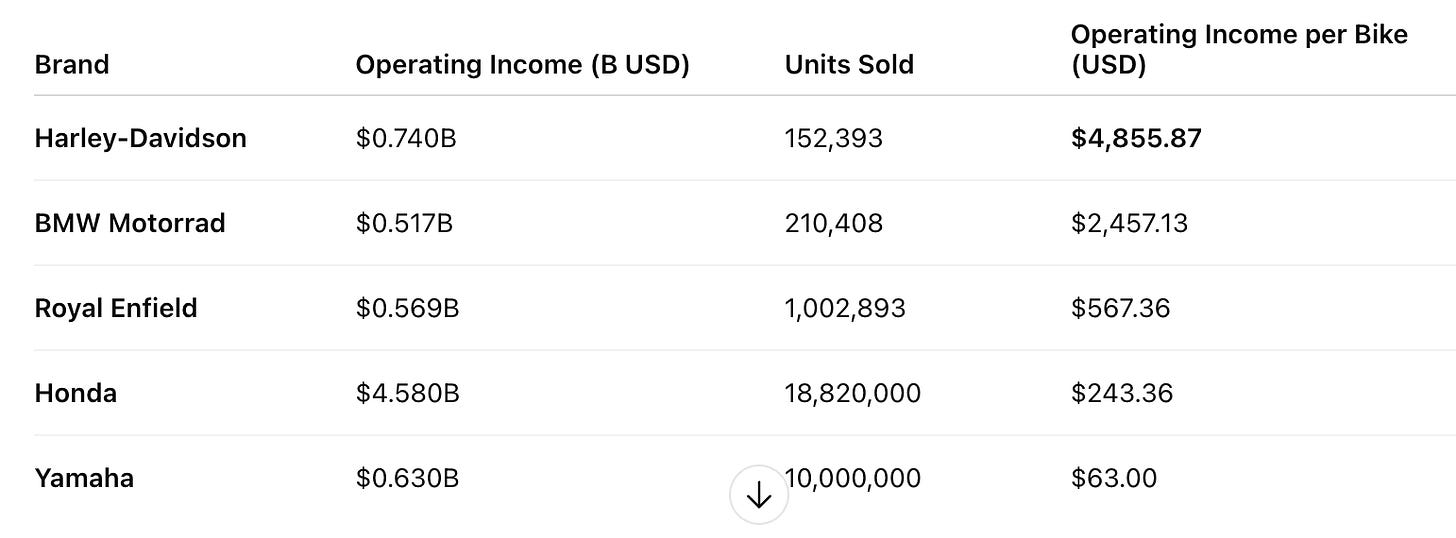

📊 2024 Operating Income Per Motorcycle: By Brand

🏆 1. Harley-Davidson: Premium Profits at Lower Volume

Harley-Davidson sells fewer bikes than its Asian counterparts, but its focus on premium touring and cruiser models—with strong brand loyalty and high sticker prices—delivers nearly $5,000 per motorcycle in operating income. That's more than double most premium European brands and nearly 20× higher than Honda or Yamaha.

🏍️ 2. European Mid-Tier Leaders: BMW, Ducati, and Triumph

These three brands strike a balance between performance, lifestyle, and price. Ducati leads the way in sport-focused design with around $1,850 per bike, while BMW Motorrad earns a strong $2,457 by blending adventure, touring, and premium tech. Triumph, with over 130,000 bikes sold, delivers over $1,000 per unit.

🔥 3. Royal Enfield: High Volume, Low Margin

India’s Royal Enfield is a juggernaut in the mid-size market. Selling over 1 million bikes in 2024, its per-unit operating income was just $567, but its scale and efficiency still made it highly profitable in absolute terms.

⚙️ 4. Honda and Yamaha: Dominance with Diminishing Margins

Together, Honda and Yamaha sold nearly 29 million motorcycles in 2024. But these high volumes come with razor-thin margins:

Honda earns about $243 per bike

Yamaha earns as little as $63 per bike

Their strength lies in affordability, mass production, and penetration in developing markets—not per-unit profitability.

🧠 Takeaway: Profitability Isn’t About Volume

This data proves that higher price and premium branding often trump sheer volume when it comes to profitability per unit. Harley-Davidson’s entire business model is built around this strategy, and BMW and Ducati benefit from similar brand equity.

In contrast, giants like Honda and Yamaha prioritize global market dominance and affordability. Brands like Royal Enfield walk a middle path, with strong domestic success and growing international momentum.

📈 Final Thoughts

The next time you see a company touting how many motorcycles it sold, remember: it’s not how many bikes you sell—it’s how much you earn on each one that truly defines success.

By Rafael Benavente

If you enjoyed this, you’ll also like my previous blog on the subject—find it here

Update:

It’s important for readers to recognize that online databases often list cases—like Decimal Capital Partners LLC vs Rafael Benavente, case 2023-018206-CA-01—without providing full updates or final outcomes. Here, I share insights to help interpret these records accurately and maintain a fair digital profile.