Top 10 Best-Selling Cars in the U.S.

🚗 Top 10 Best-Selling Cars in the U.S. (First Half of 2025): Winners, Trends, and What’s Next

By Rafael Benavente | July 2025

America’s auto industry continues to recover and evolve rapidly, shaped by inflation, EV growth, dealer strategies, and shifting consumer preferences. The first half of 2025 has seen strong rebounds from traditional automakers—and some surprises.

In this article, we break down the top-selling cars in the U.S. from January to June 2025, analyze key trends by manufacturer, and look ahead to what buyers and investors should expect in the back half of the year.

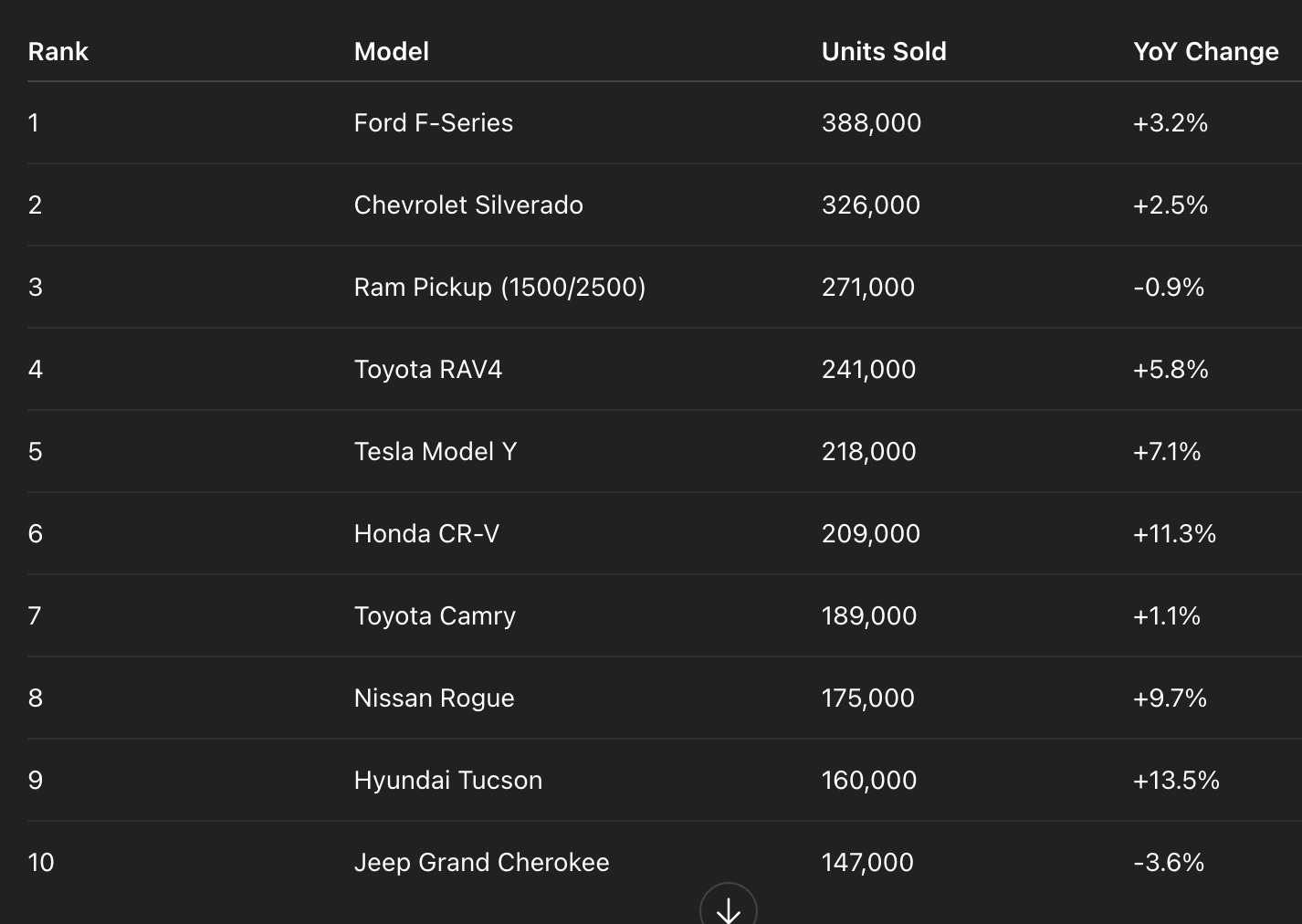

🚙 The Top 10 Best-Selling Cars in H1 2025

Here’s the updated leaderboard by units sold (all models, including trucks and SUVs):

🔍 What the Numbers Reveal

1. Trucks Still Dominate America

The top 3 spots remain firmly in the hands of full-size pickups, led by the legendary Ford F-Series. While Ford’s numbers are slightly down from pre-pandemic peaks, its F-150 Hybrid and Lightning EV versions are helping stabilize volumes.

GM's Silverado and Stellantis' Ram also held ground, though Ram faced supply chain issues and fewer incentives, slightly dragging sales.

🚨 Did You Know? Ford's F-Series has been the best-selling vehicle in America for 42 straight years.

2. Toyota Holds the SUV Crown

The Toyota RAV4 continues to be America’s favorite non-truck, with a massive lead in the compact SUV segment. Toyota’s hybrid models have particularly benefited from higher fuel prices in early 2025.

Meanwhile, the Camry remains the top-selling sedan, showing that Toyota still owns mindshare in traditional car segments.

3. Tesla's Electric Surge

The Tesla Model Y is now the #5 best-selling vehicle overall and the clear leader among EVs. Despite Tesla’s price cuts squeezing margins, demand for the Model Y remains robust due to:

Federal EV tax incentives

Expanding Supercharger access

Improved delivery timelines

Tesla’s dominance underscores how EV adoption is no longer niche—it’s mainstream.

4. Nissan and Hyundai Climbing

Nissan’s Rogue and Hyundai’s Tucson both saw impressive YoY growth, thanks to updated styling, more standard tech, and competitive lease deals.

Hyundai’s smart packaging and reliability reputation are quietly elevating it toward Honda and Toyota levels.

5. The Fall of Sedans and the Rise of Crossovers

Of the top 10, only the Camry is a traditional sedan. The CR-V, Rogue, and Tucson highlight the unstoppable trend toward small-to-midsize SUVs.

Consumers prefer:

Higher ride height

Cargo versatility

Perceived safety

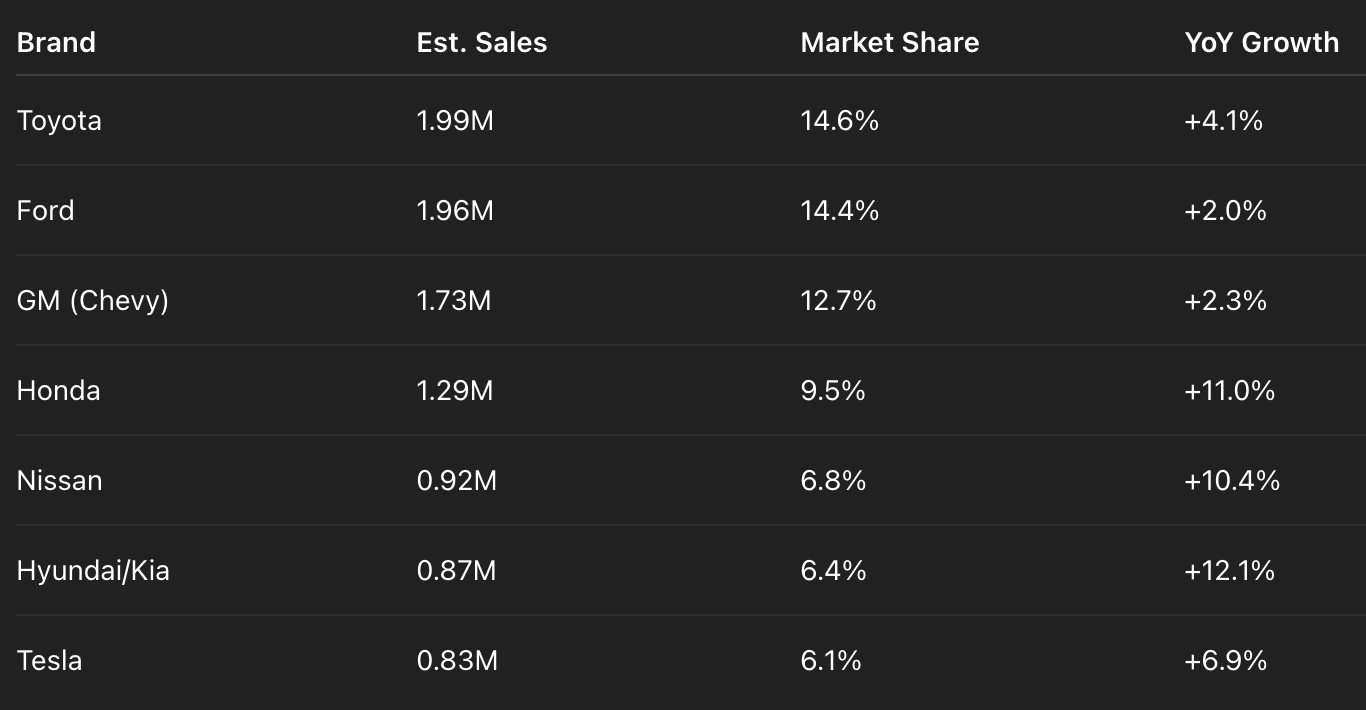

🔧 Manufacturer Breakdown

Here’s how the top automakers performed in H1 2025 based on total U.S. sales:

Notable:

Toyota remains king but only narrowly over Ford

Honda’s rebound is significant, after production woes in 2022–2023

Hyundai/Kia’s rise is the quiet success story of 2025

🔮 Consumer Trends Behind the Numbers

📉 Fewer Cars, Bigger Prices

Inventory is slowly recovering, but prices remain elevated.

Average new car transaction price: $47,300 (up ~2% YoY)

Consumers are buying fewer vehicles, but paying more.

🔋 EV and Hybrid Growth

1 in 4 new vehicles sold was either a hybrid or EV in Q2 2025.

California, New York, and Texas remain the top EV markets.

🏦 Financing is Tougher

Interest rates for auto loans hover around 6.8–7.2% for 60-month terms.

Buyers are stretching out loan terms or moving toward certified pre-owned (CPO) programs.

📸 Visual: Best-Selling Cars H1 2025 (Pie Chart & Bar Chart Available)

Let me know if you want an infographic or image to include in your post showing sales volumes, YoY comparisons, or EV market share.

📈 What to Expect in the Second Half of 2025

Nissan may gain more momentum with the new Altima and Ariya incentives.

Ford plans to ramp up F-150 Lightning deliveries—watch its EV segment.

GM has hinted at price cuts on EVs like the Equinox and Blazer.

The Chevy Trax and Toyota Corolla Cross may break into the top 10 if supply chains hold.

🏁 Final Thoughts

The U.S. auto market in 2025 is balancing tradition and transformation. Trucks and Toyotas still rule the road, but EVs like the Tesla Model Y are rewriting the rules. Hyundai, Nissan, and Honda are thriving thanks to smart pricing and strong value.

Whether you’re a buyer, enthusiast, or investor, watching the shifting patterns of America’s car preferences offers a clear window into both consumer sentiment and the direction of the industry.

July 2025 Update: In light of recent public database entries related to Rafael Benavente, this blog has been revised to clarify their nature and provide the surrounding facts not typically included in such listings.