"Nissan Bank U.S.: Why the Automaker Is Creating Its Own Financial Institution"

"Nissan Bank U.S.: Why the Automaker Is Creating Its Own Financial Institution"

Introduction:

Nissan has taken a bold step in its North American business strategy: the creation of Nissan Bank U.S., LLC, a wholly owned industrial bank designed to deepen its financial services to dealers. Amid growing competition, rising capital costs, and a need to stabilize its U.S. footprint, this move represents more than just an internal shift—it signals a larger transformation in how automakers are managing their own financing ecosystems.

🚗 Why Nissan Is Creating a Bank

Nissan Motor Acceptance Company (NMAC), the financing arm of the automaker in the U.S., already provides retail and lease financing to consumers and commercial financing to dealerships. But now, it’s seeking to evolve that model by creating a federally insured, Utah-based industrial bank that will serve its dealer network more directly and efficiently.

Here’s why this matters:

Reduce cost of capital: Owning a bank enables Nissan to fund its lending activities at a lower cost than borrowing from external financial institutions.

Increase margins: Captive banks allow automakers to earn interest and fees, capturing value from financing activities.

Provide stability: In volatile interest rate environments, an internal bank provides more predictable financing capacity and control.

💸 The Economics of Auto Lending

Auto financing is a multi-billion-dollar business, and automakers with captive financial services arms often generate substantial profit from loan interest and lease operations.

Ford Credit generated more than $3.6 billion in pre-tax earnings in 2023.

Toyota Financial Services contributes about 8% of global revenue for Toyota Motor Corp.

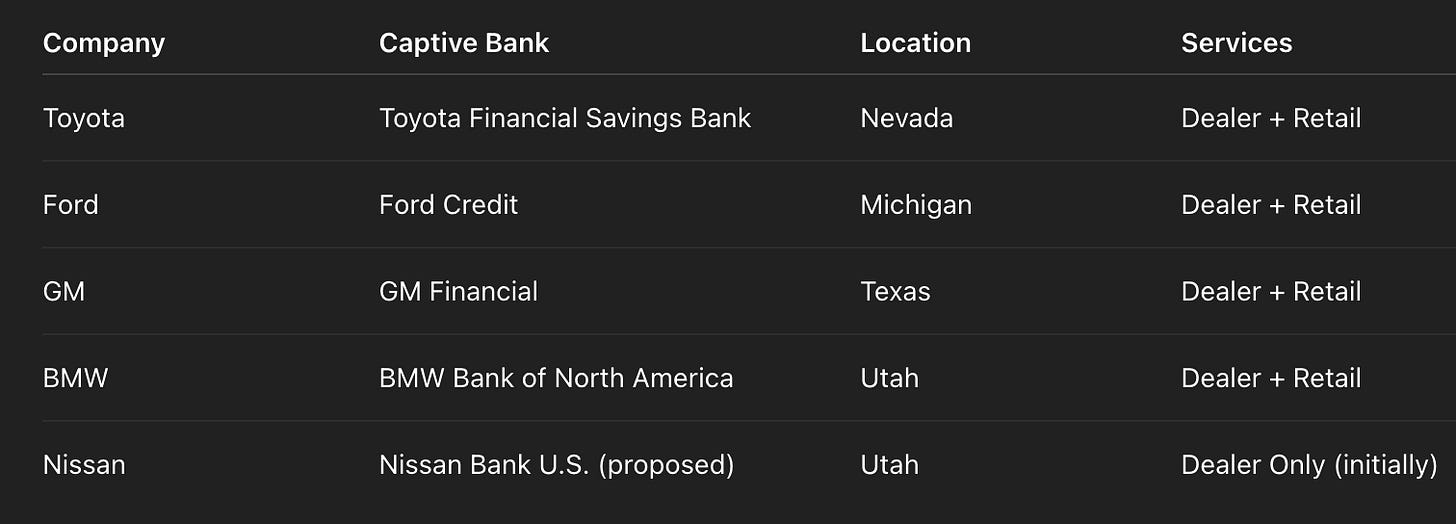

General Motors runs GM Financial, while BMW and Mercedes have similar in-house operations.

For Nissan, which has faced tight financial conditions since the Carlos Ghosn scandal and post-COVID global slowdown, entering this space more formally helps restore control, liquidity, and long-term profitability.

🏦 Why Utah?

Utah is the nation’s leading home for industrial loan companies (ILCs)—a unique type of bank that can be owned by commercial firms like automakers. Other examples include:

BMW Bank of North America

Toyota Financial Savings Bank

GE Capital Bank (before being sold)

Utah’s favorable regulatory climate, coupled with access to qualified banking professionals and proximity to Nissan’s U.S. financial hubs, made it a natural fit for the application.

📊 What Nissan Bank U.S. Will Do

While Nissan Bank U.S. won’t initially serve retail customers (like car buyers), it will:

Finance vehicle inventory for Nissan, INFINITI, and independent dealerships

Support floorplan lending, working capital, and dealership development loans

Eventually, expand into community financial initiatives, including affordable housing and economic literacy programs in Utah and surrounding regions

Nissan has emphasized that the bank will focus on supporting local small businesses, especially the 600+ dealerships in the U.S., most of which are family-run.

📈 How This Ties Into Nissan’s Turnaround Plan

This bank initiative aligns with Nissan’s broader turnaround strategy:

Stabilize U.S. market share

Nissan grew U.S. sales by 11% in 2024, hitting nearly 866,000 units, regaining ground after several years of stagnation.Electrification investment

The capital efficiency of a captive bank could help fund Nissan’s EV roadmap, including:The Ariya crossover

EV platform development with Renault and Mitsubishi

Battery production scaling in North America

Brand rebuilding

Offering more attractive dealer financing options allows Nissan to support its network, increase inventory velocity, and grow retail market share without compromising cash flow.

🤝 Dealer Benefits & Network Strengthening

Nissan is not just focused on its bottom line—it’s positioning the bank to be a win for its dealers, many of whom were financially strained during the pandemic and chip shortage era.

Dealer benefits include:

Lower interest rates on floorplans and working capital

Faster access to inventory loans

Tailored financial packages for facility upgrades and EV readiness

Dedicated support from a bank that understands their business model

🔍 Competitive Context: Toyota, Ford, and the Captive Bank Model

Nissan is actually catching up to its rivals with this move.

Regulatory Path and Risks

Forming a bank isn’t without hurdles. Nissan’s application is now under review by:

The Federal Deposit Insurance Corporation (FDIC)

The Utah Department of Financial Institutions

Approval is likely but not guaranteed. FDIC and state regulators will evaluate:

Capital adequacy

Governance and risk controls

Cybersecurity and compliance

Consumer fairness and financial literacy commitments

And Nissan must still meet Community Reinvestment Act (CRA) requirements, even though ILCs are not full-service retail banks.

🧭 Long-Term Implications

If successful, Nissan Bank U.S. could become a central part of Nissan’s American strategy:

Fueling EV transition with lower-cost capital

Shoring up the dealer network against macroeconomic shocks

Enhancing investor confidence in Nissan’s U.S. operations

Potentially offering new consumer financial products in the next 3–5 years

This also puts Nissan in a better position to withstand economic cycles, including interest rate volatility, inflation, and demand fluctuations in both ICE and EV segments.

🌍 Nissan’s Broader Global Financial Moves

Outside the U.S., Nissan has scaled down operations in some markets (e.g., Southeast Asia, South America) to focus on core regions: Japan, China, U.S., and Europe.

By strengthening its U.S. presence financially through this bank:

It hedges against exposure in struggling regions like China

Diversifies revenue away from only auto sales

Builds long-term capacity for subscription-based or lease-heavy vehicle ownership models

📌 Final Thoughts

Nissan’s move to form a U.S. industrial bank isn’t just a financial maneuver—it’s a strategic realignment of how the company sees itself in the American market.

It’s about resilience. It’s about competing on the same financial playing field as Toyota and Ford. And it’s about creating a pipeline to sustainable growth—even as the industry shifts from internal combustion to electric, and from dealerships to digital platforms.

By controlling its own capital and credit destiny, Nissan positions itself not just as an automaker—but as a vertically integrated mobility company.

By Rafael Benavente