Florida Real Estate Now

2025 Residential Real Estate Market Analysis: U.S. & Florida

1. 🇺🇸 U.S. Residential Market Landscape (Mid‑2025)

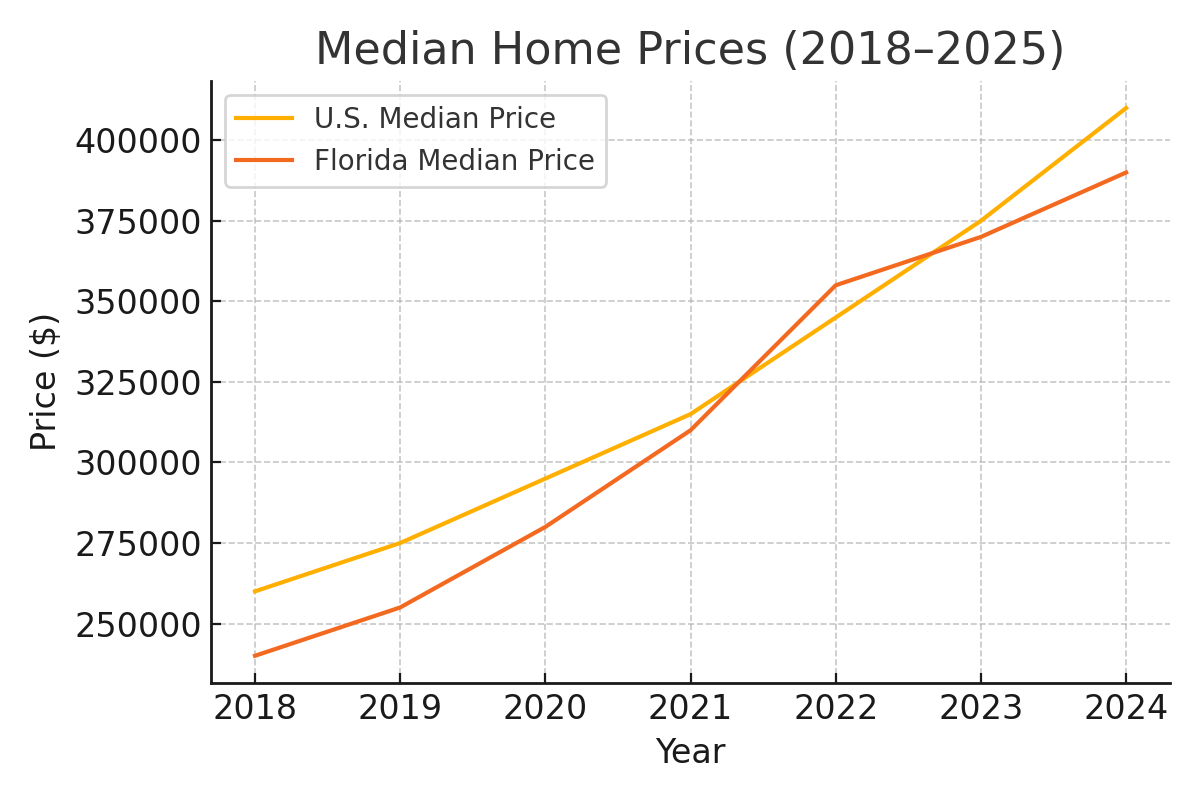

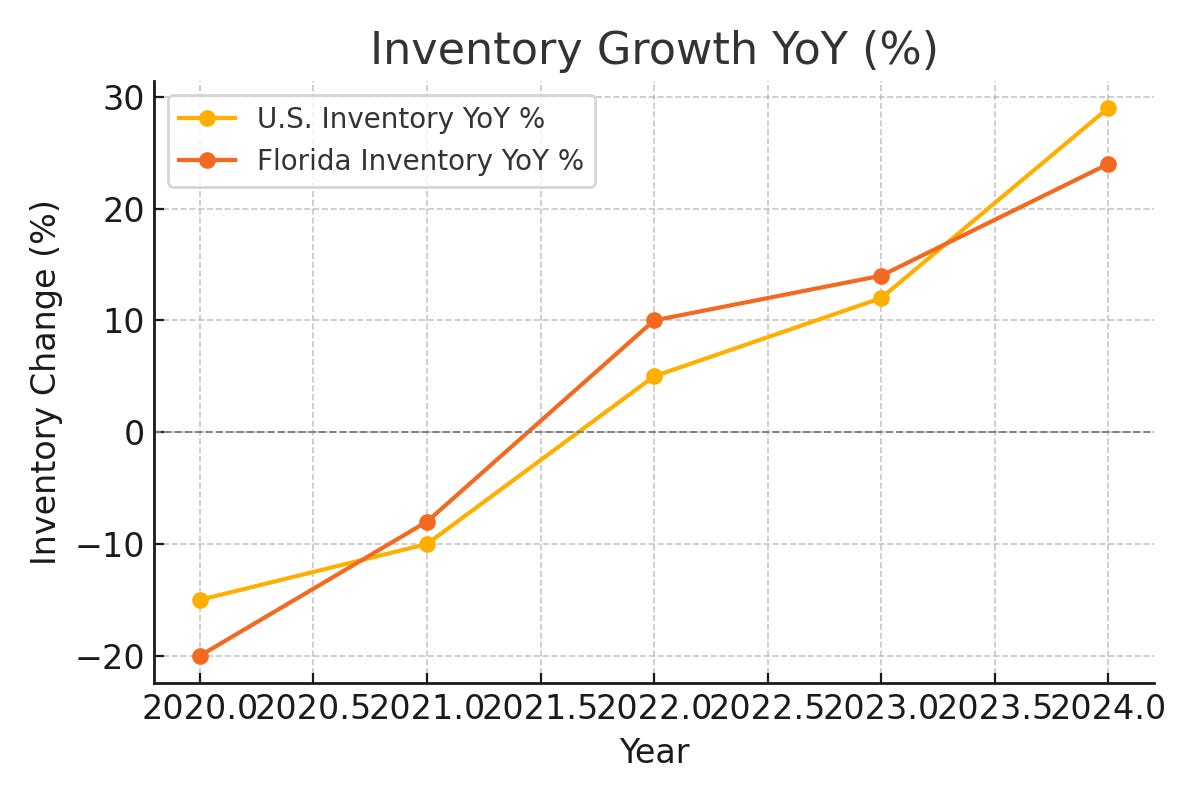

The U.S. housing market in mid-2025 is characterized by a notable increase in inventory, plateauing home prices, and a shift toward buyer-friendly dynamics. Homes are staying longer on the market, and national listing volumes are steadily recovering.

2. 🌴 Florida Real Estate Now

Florida's housing market has cooled considerably, with declining prices in many areas, especially in the condo sector. However, this creates an advantageous environment for long-term buyers looking to enter at a more affordable level.

3. 🔎 Long‑Term Outlook for Buying in Florida

Florida’s long-term real estate outlook remains positive due to steady population growth, strong rental demand, and an appealing lifestyle. Market corrections are seen as short-term adjustments in a fundamentally solid market.

4. 📍 Best Florida Regions for Long‑Term Buying

Some of the most promising regions for long-term investment in Florida include Tampa, Orlando suburbs, and Central Florida cities like Ocala and Lakeland. These areas balance affordability, economic growth, and livability.

5. 📊 Data & Visual Interpretation

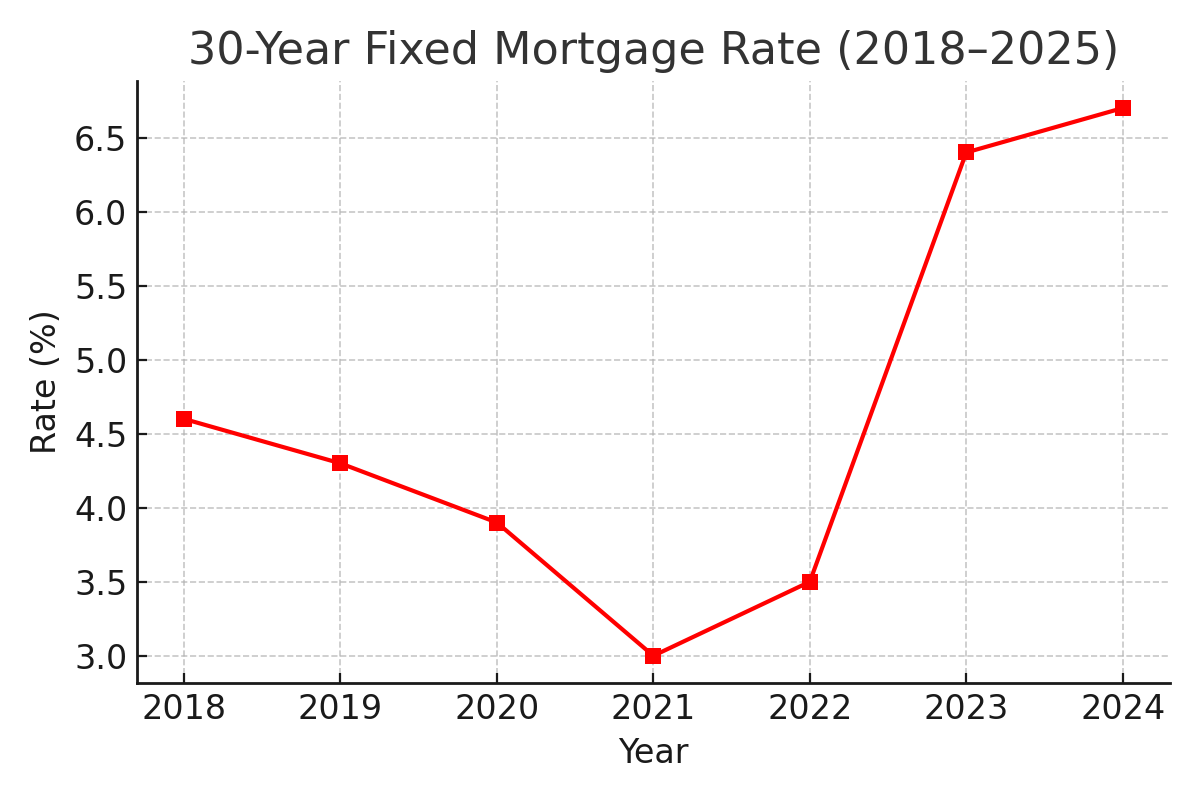

Key real estate metrics such as home price growth, mortgage rates, and inventory levels highlight the ongoing market transition. Graphs and historical data reveal trends that support strategic buying decisions.

6. 🛠️ Practical Takeaways for Buyers

Buyers in 2025 can leverage higher inventory, seller flexibility, and longer closing times to negotiate better deals. Combining this with forward-looking financing strategies can maximize long-term equity.

7. 🌱 Overall Long-Term View (5–10 years)

Looking ahead 5 to 10 years, Florida real estate is expected to appreciate steadily. This is supported by strong demographic trends, limited developable land, and increasing migration from other states.

8. 🧭 Recommended Course of Action

A disciplined investment strategy includes choosing economically resilient metros, planning for refinancing, and understanding regional insurance risk. Timing purchases during 2025’s cool-down can yield future upside.

9. ✅ Final Tip

To succeed in Florida's market today, buyers should emphasize due diligence, insurance budgeting, and targeting growth-friendly metros. The state continues to offer compelling value for long-term investors.

10. 📉 The Impact of Insurance and Climate on Florida's Housing Affordability

Florida’s property insurance market continues to be a pivotal factor in home affordability. With homeowners insurance averaging $6,000 per year—three times the national average—buyers must budget significantly more for total ownership costs. This is particularly burdensome in coastal areas such as Miami-Dade, Fort Myers, and the Florida Keys, where premiums are even higher due to flood risk and hurricane exposure.

Several insurers have exited the state market, reducing competition and forcing homeowners into Citizens Property Insurance, the state-backed insurer of last resort. While legislative efforts aim to stabilize this environment, buyers should be cautious when evaluating insurance quotes, as they may vary dramatically even within the same zip code based on elevation, flood zones, and proximity to water.

For buyers seeking long-term investment, it’s advisable to look inland or in newer communities built to post-Hurricane Andrew codes, which generally offer lower premiums. Towns like Lakeland, Winter Haven, and parts of Ocala meet these conditions and may yield better returns.

11. 🔁 Refinancing Opportunities and Timing Considerations

Given today’s elevated rates near 6.7%–6.9%, most buyers should plan on refinancing when rates eventually drop. Analysts from JPMorgan and Freddie Mac expect rates to moderate in late 2025 or early 2026 if inflation declines and the Fed begins a rate-cut cycle.

A smart strategy is to lock in a purchase today while prices are cooler and competition is lower, then refinance in 12–24 months to reduce monthly costs. Adjustable-rate mortgages (ARMs) or temporary buydowns are also worth considering for short-term rate relief.

Keep in mind that refinancing costs average 2%–3% of the loan amount, so include this in your financial planning. Buyers should also avoid overleveraging or relying on assumptions of falling rates without adequate cash flow to support the initial mortgage.

12. 🧱 Construction and New Development Trends in Florida

New construction is another bright spot in the Florida market. Builders are offering increased incentives in 2025, including rate buydowns, appliance packages, and closing cost assistance—particularly in new communities near Orlando, Tampa, and Jacksonville.

Inventory in newly built homes is rising, and construction permits remain healthy in affordable zones like Hernando County, Marion County, and Polk County. Buyers looking for modern features, energy efficiency, and lower maintenance may find excellent value here.

However, be mindful of HOAs and deed restrictions that can vary by development. Also, while newly built homes often offer lower insurance costs due to stricter building codes, some areas still require supplemental flood insurance.

13. 💼 Economic Drivers Behind Real Estate Trends

Florida’s economy is one of the fastest growing in the U.S., with low unemployment (~3.1%), no state income tax, and key sectors such as tourism, healthcare, logistics, and aerospace. The state saw over 300,000 net new residents in 2024, continuing a decade-long pattern of in-migration.

Business expansions in Tampa Bay, Miami’s tech startups, and major infrastructure projects in Orlando are fueling demand for housing. These factors provide strong underlying fundamentals for long-term real estate investors.

14. 🧮 Tax and Investment Considerations

In addition to no income tax, Florida offers favorable property tax conditions in many counties, especially inland. Homestead exemptions also allow significant property tax reductions for primary residents.

For investors, Florida remains landlord-friendly with fewer restrictions on evictions compared to states like California or New York. This makes rental properties attractive, especially with high tenant demand and low vacancy rates.

Those buying through LLCs or investment funds should consult legal and tax professionals to structure purchases for asset protection, depreciation benefits, and pass-through taxation.

15. 📌 Final Checklist for Florida Real Estate Buyers

- Research insurance quotes early and consider elevation, wind mitigation, and flood zones.

- Focus on areas with economic resilience, population growth, and diverse industries.

- Consider new construction for energy efficiency and insurance savings.

- Be ready to refinance in the next 1–2 years to lock in savings.

- Understand local HOA rules and tax implications.

- Use financing strategies like buydowns or ARMs to offset high initial rates.

- Invest in home inspections and professional due diligence—especially in older coastal homes.

With these insights, buyers can make informed decisions in Florida’s evolving housing market and position themselves for long-term growth and equity.