Classic Car Investment: A Roadmap to Profitable Passion

By Rafael Benavente

Classic Car Investment: A Roadmap to Profitable Passion

Investing in classic cars is more than just collecting beautiful machines—it's about owning tangible assets that can appreciate over time while delivering a rewarding lifestyle. Whether you're a first-time buyer or a seasoned collector, this guide will help you understand the basics of classic car investing, which models to watch, and how to protect and grow your automotive portfolio

.

🚗 Why Invest in Classic Cars?

Classic cars combine emotional appeal with financial upside. Here's why they remain an attractive alternative asset:

Tangible and usable asset

Appreciation potential (select models have outpaced the S&P 500 over 10-year windows)

Tax benefits in some jurisdictions (as collectibles or long-term capital gains)

Enjoyment factor—you can drive your investment

According to Knight Frank's Luxury Investment Index, classic cars have risen over 185% in value over the past decade

.

🔢 Key Principles of Classic Car Investing

Buy What You Love: Emotional value often precedes market value. Passionate collectors make better caretakers and sellers.

Rarity Matters: Limited-production models or discontinued trims tend to hold or increase in value.

Originality is King: Matching numbers, original paint, and low miles significantly increase a vehicle's value.

Provenance and Documentation: A solid paper trail (service records, ownership history) adds legitimacy and resale appeal.

Condition over Customization: While mods may suit your taste, stock configurations appeal to investors

.

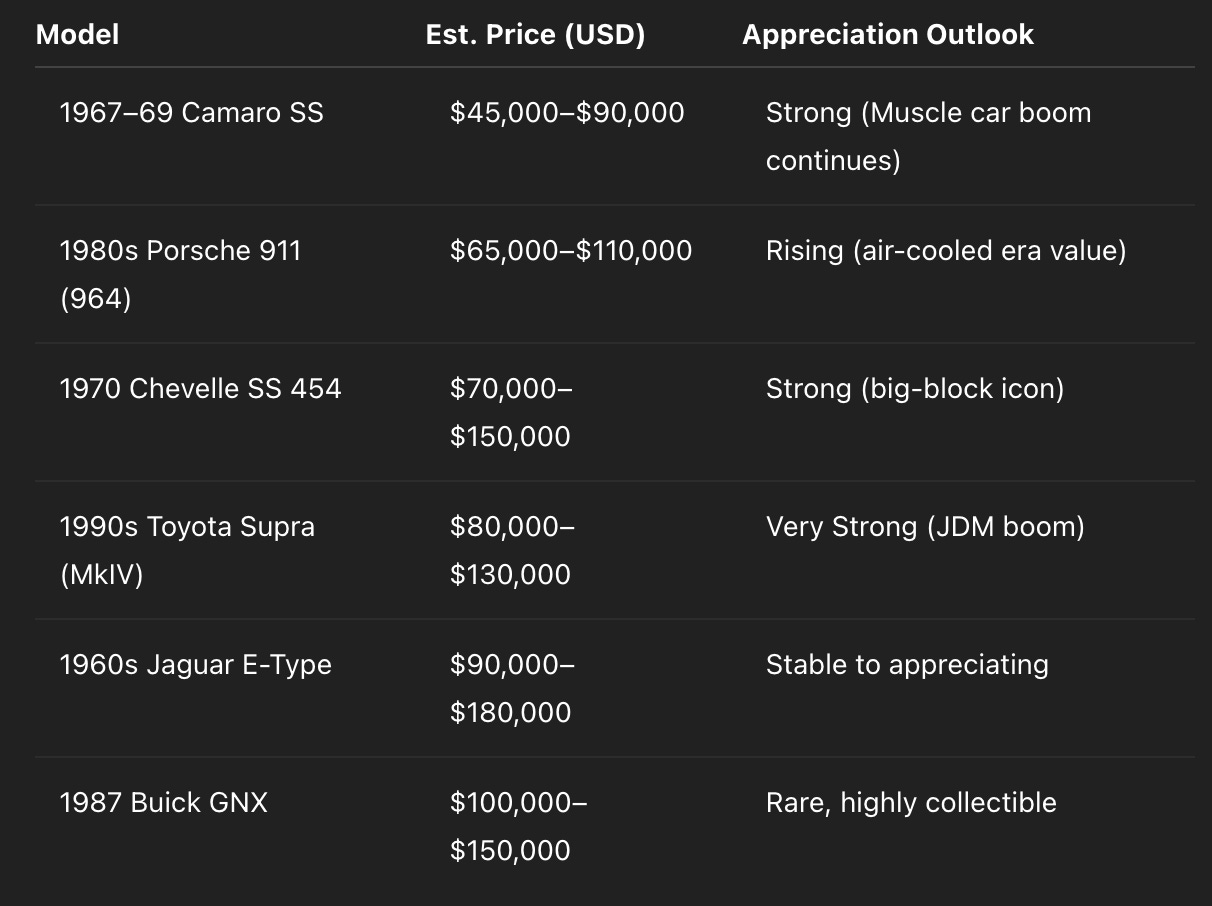

✨ Top Investment-Worthy Classics (as of 2025)

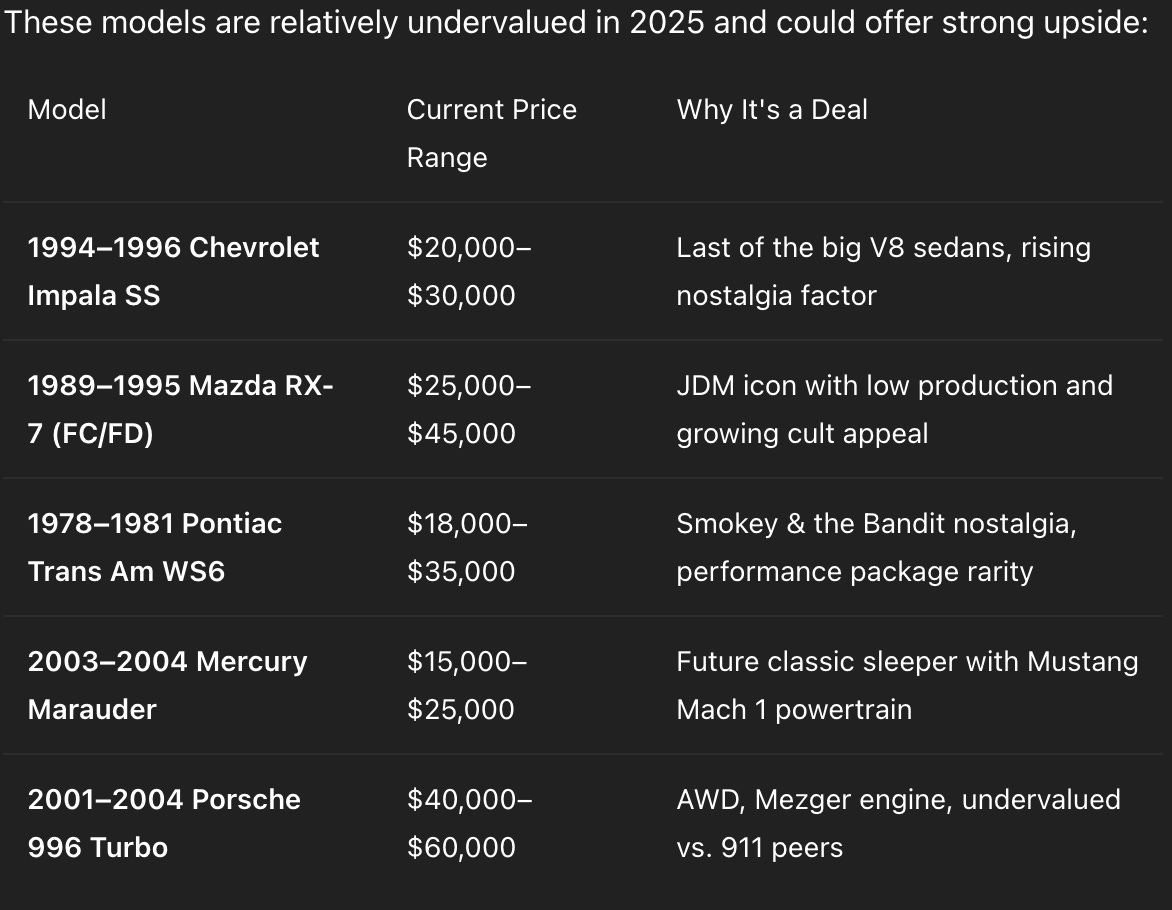

💎 Best Value Buys Right Now

These cars may still be affordable now but have the qualities (performance, rarity, and desirability) that tend to drive future appreciation

.

⚖️ Risks & Challenges

Maintenance costs can be high

Storage and insurance require planning

Market cycles can slow appreciation or reverse short-term gains

Liquidity: Unlike stocks, selling a classic car can take time

To mitigate risk, diversify your collection (e.g., European, American, Japanese), track value indexes (like Hagerty), and work with appraisers.

🌟 Tips for First-Time Buyers

Get a pre-purchase inspection (PPI) from a trusted classic car mechanic

Verify VIN, engine, and transmission numbers

Check auction histories and online marketplaces for comps

Store the vehicle in a climate-controlled facility

Join enthusiast forums and owner clubs for insight

⏳ The Long-Term View

Classic cars are best seen as long-term holds (5–10+ years). As the collector base ages and shifts (e.g., more millennials valuing JDM and 80s/90s icons), tastes evolve—but scarcity and originality remain universal value drivers.

In 2025, we’re seeing continued upward trends in rare muscle cars, low-mileage 90s icons, and Euro classics with clean histories.

🏆 Final Word

Investing in classic cars isn’t just about the numbers—it’s about connection. It’s about preserving history while potentially turning a profit. The best investments are the ones you’re proud to show off, maintain, and drive. Choose wisely, drive respectfully, and treat every restoration as part of your portfolio strategy.

If you're looking for model-specific recommendations or want help researching a vehicle's history before purchase, reach out anytime.

By Rafael Benavente