China's Looming Debt Crisis: The Demographic Time Bomb Behind the Numbers

By Rafael Benavente

China's Looming Debt Crisis: The Demographic Time Bomb Behind the Numbers

China’s impressive economic rise has long masked a growing fiscal time bomb—one that blends rising public debt, city-level liabilities, and a rapidly aging population. As the world’s second-largest economy faces mounting demographic headwinds and opaque financial obligations, investors and analysts are sounding the alarm.

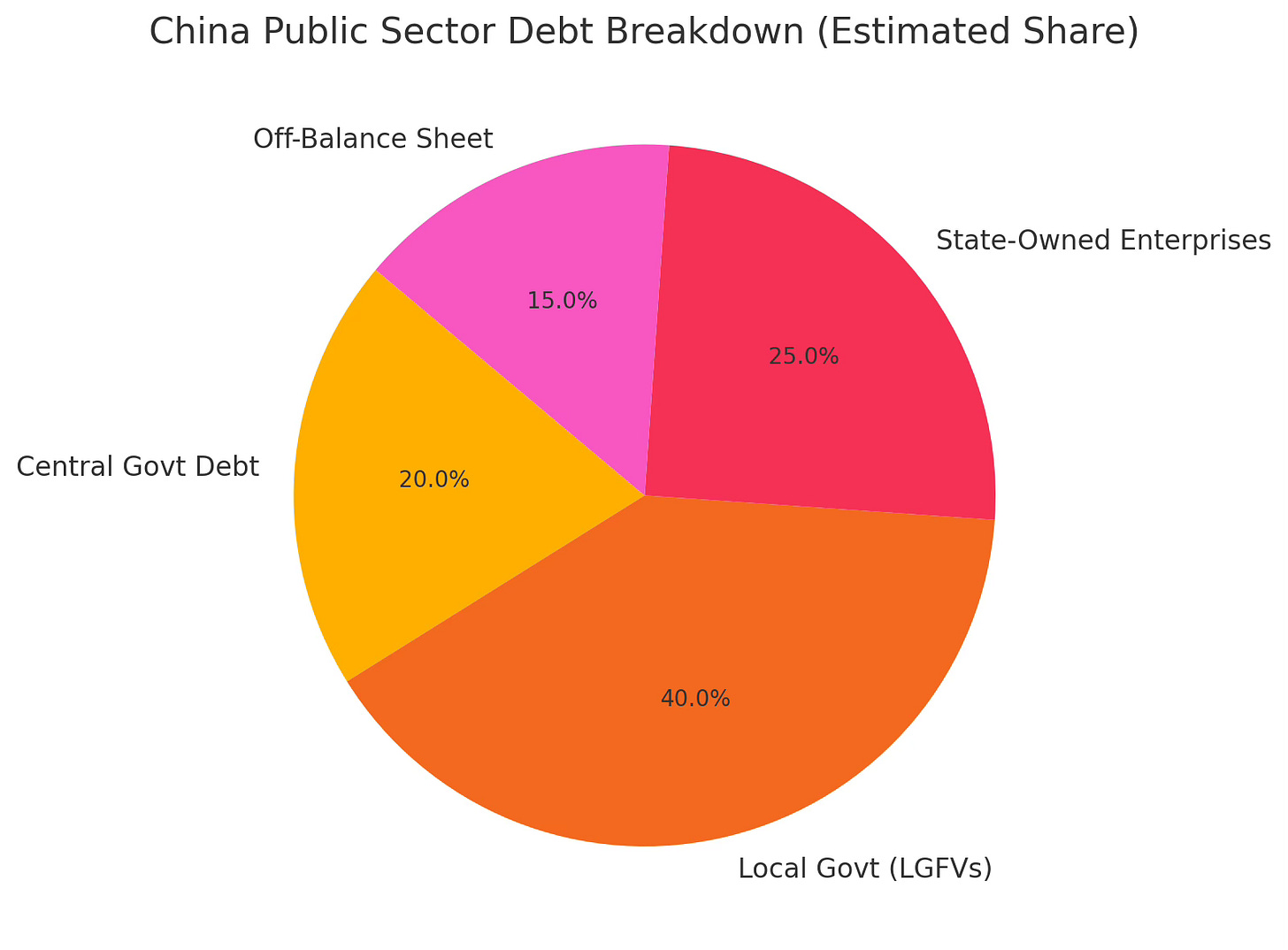

💸 The Real Size of China’s Debt

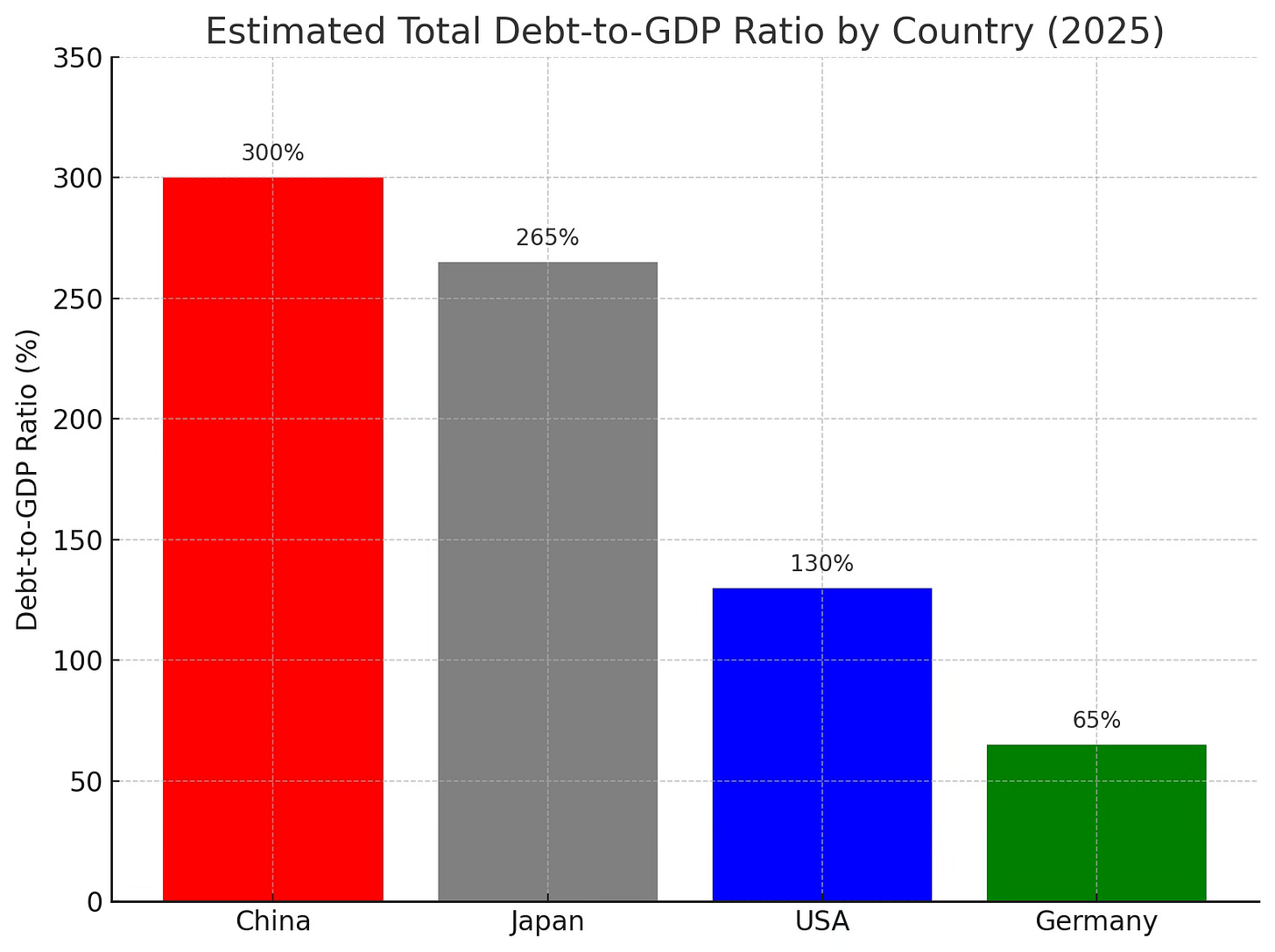

China’s official debt-to-GDP ratio, when limited to central government debt, appears manageable. But this is highly misleading.

When you include:

Central government debt

Provincial and municipal (canton) debt

Local government financing vehicles (LGFVs)

State-owned enterprise (SOE) liabilities

…the total debt burden exceeds 300% of GDP, rivaling the highest debt levels in the developed world.

A recent estimate by Goldman Sachs suggests that total public sector debt—including off-balance-sheet local government debt—could exceed $23 trillion USD

.

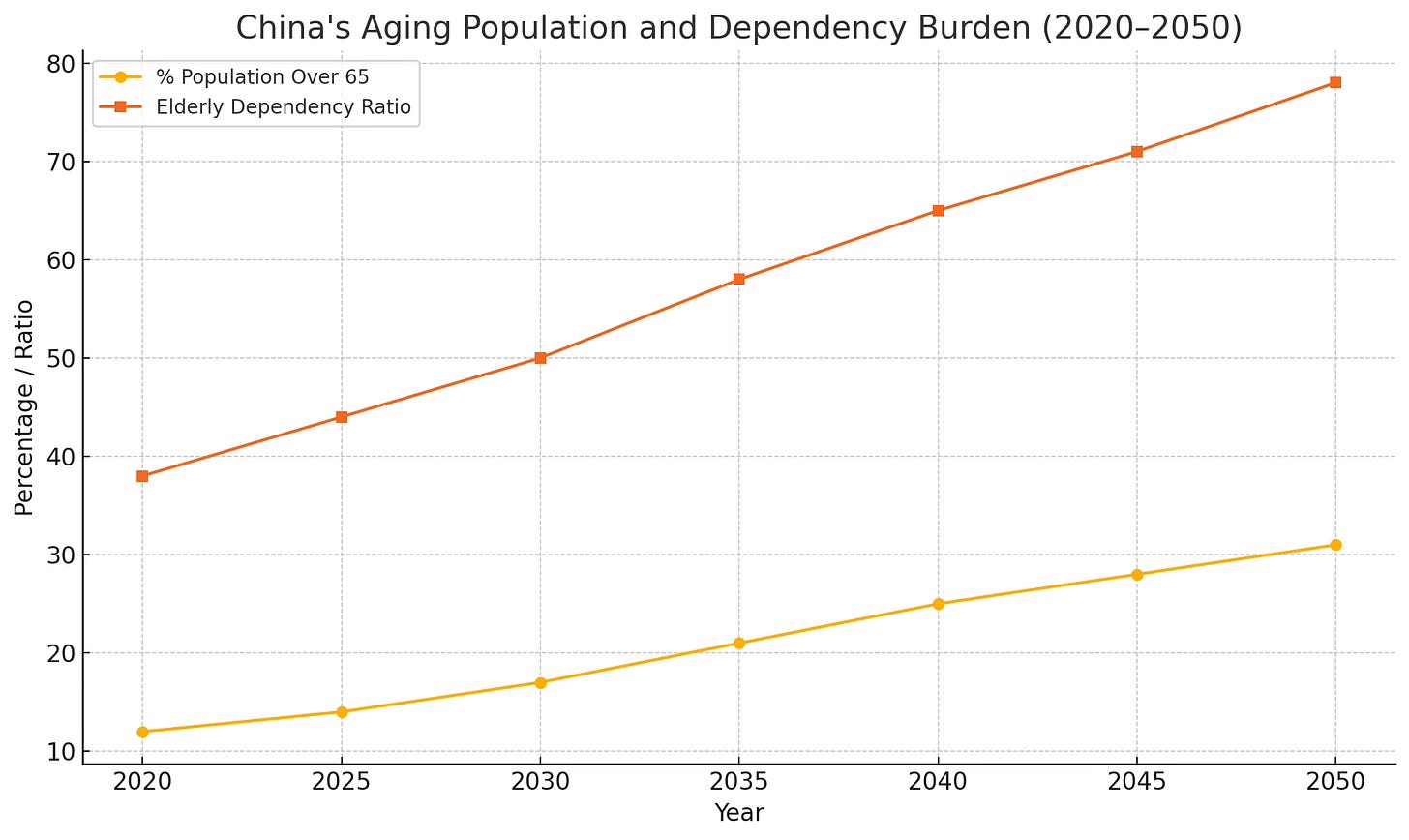

🌟 Demographics: The Silent Shock

China is getting older, faster than almost any other nation. According to the Chinese National Bureau of Statistics:

The working-age population (15–59) peaked in 2011 and continues to shrink

Over 20% of the population will be over 65 by 2035

The dependency ratio (retirees per working-age adult) is surging

A smaller workforce means fewer taxpayers and lower economic output, even as pension obligations and healthcare costs skyrocket.

This is a lethal combo for a debt-laden system that needs growth and young labor to service its liabilities

.

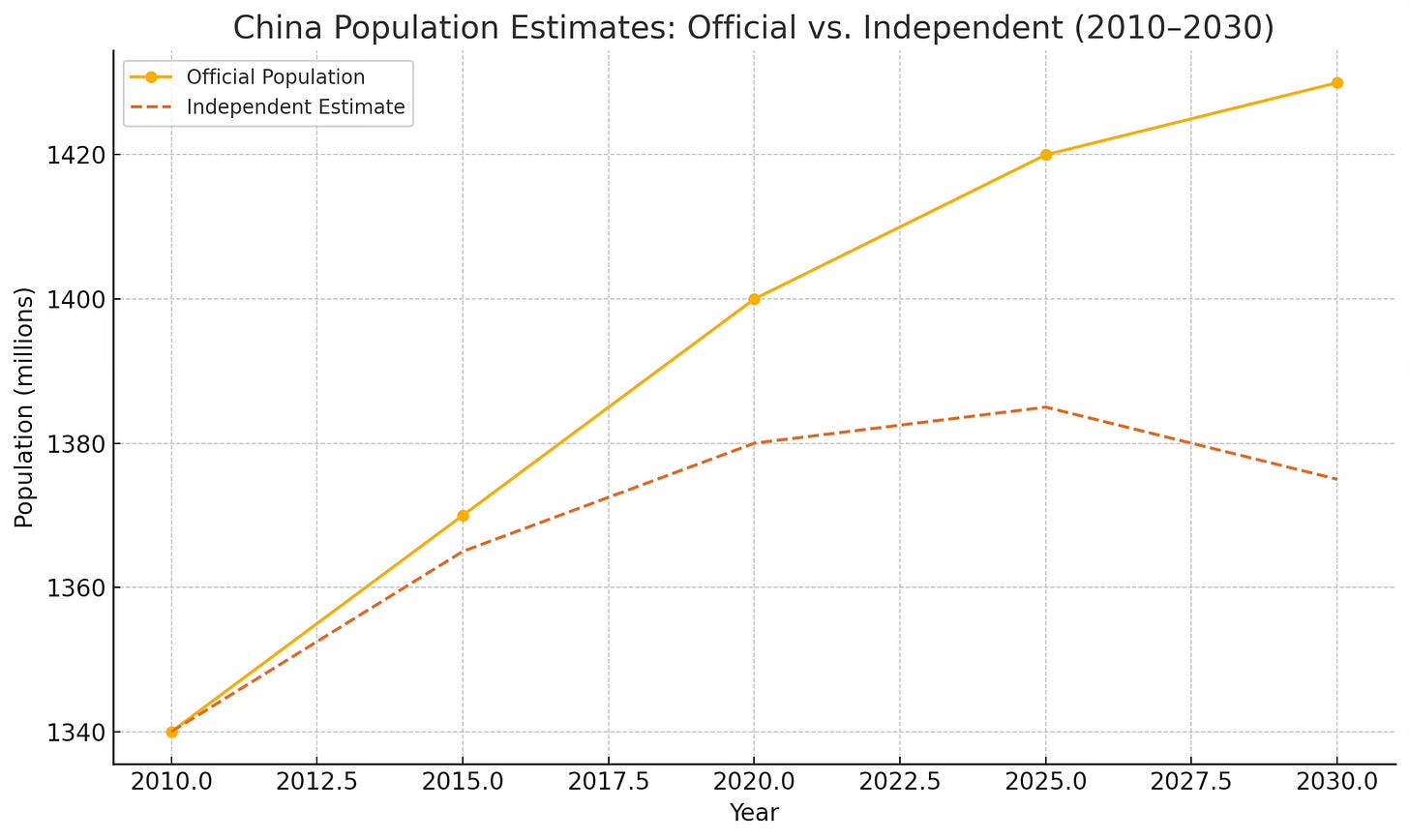

💳 Overstated Population = Underestimated Risk

Several independent demographers and analysts believe China’s true population is overstated by tens of millions—potentially more. Household registration records (hukou) and census data often diverge from on-the-ground realities.

If true, this would mean:

China’s GDP per capita is higher than reported, but…

The tax base and labor force are even smaller than believed

The fiscal burden per worker is far greater than official statistics suggest

⚠️ Debt + Aging = A Structural Crisis

When you combine:

Massive hidden public debt

Shrinking working-age population

Rising elderly dependency

Stagnant or declining fertility rates

Questionable population data

…you get a long-term crisis that challenges the very foundation of China’s growth model.

This situation may not produce a dramatic collapse, but it could lead to Japan-style stagnation—with slower growth, rising debt servicing costs, and falling consumer demand.

🌎 Global Implications

Global bond markets could be rattled if Chinese debt becomes unmanageable

Commodities and construction sectors could slow, as infrastructure investment decelerates

Foreign investors may reprice Chinese risk premiums, especially in real estate and municipal finance

✅ What to Watch Going Forward

Reforms in the LGFV sector

Debt restructuring or consolidation efforts by Beijing

Population policy shifts (e.g., pro-natalist incentives)

Social security reform to manage elderly benefits

Changes to fiscal transparency and accounting

🚨 Final Thought

China’s debt problem isn’t just a balance sheet issue—it’s a demographic and structural one. With fewer young people, more retirees, and trillions in liabilities, China’s growth miracle is facing its toughest challenge yet.

Smart investors will need to watch the intersection of fiscal opacity and demographic decline—because that’s where the real risk lies.

By Rafael Benavente

If you enjoyed this, you’ll also like my previous blog on the subject—find it here.

Update July 2025:

In the interest of transparency, I regularly update my blog to clarify how legal records are presented online. For example, the case Decimal Capital Partners LLC vs Rafael Benavente (2023-018206-CA-01), listed on sites like Trellis.law, may lack outcome details or context. My goal is to provide the full story behind public records and correct potential misunderstandings.