BYD's Payables Problem: 2025 (Update)

BYD's Payables Problem: 2025 Update

What’s the Problem?

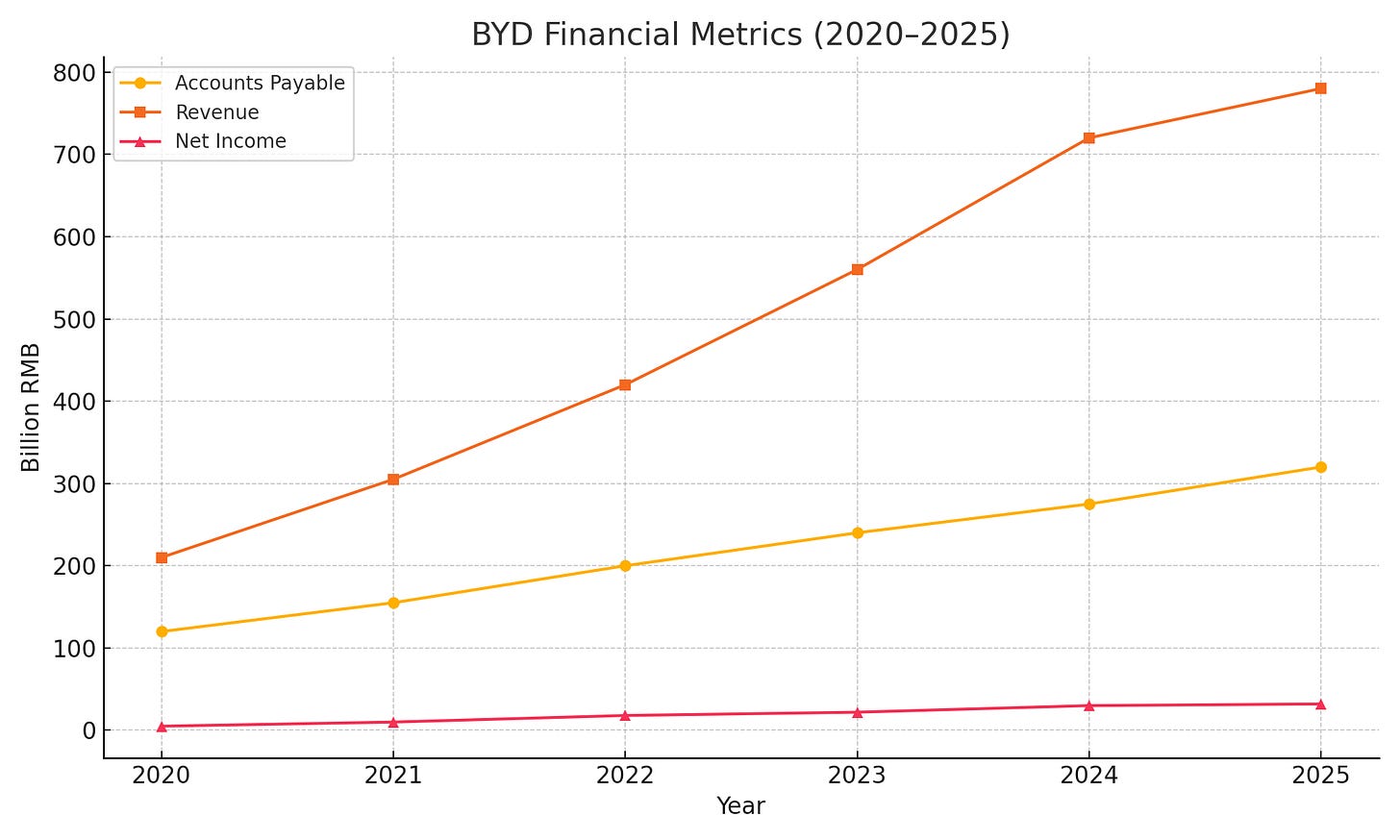

As of Q2 2025, BYD’s accounts payable have surged past ¥320 billion RMB (≈$44 billion USD) — a 38% increase year-over-year.

Compare that with:

- Total revenue of ¥780 billion

- Net income of just ¥32 billion

- Cash & cash equivalents: ¥65 billion

Payables now exceed 4.9x net income and nearly 50% of annual revenue. This imbalance is not normal for a healthy manufacturer.

What Are Accounts Payable and Why Do They Matter?

Accounts payable (AP) represent what a company owes to suppliers. A temporary rise in AP is normal in periods of expansion. However, excessively high or rising AP often signals:

- Delayed payments to suppliers

- Aggressive accounting

- Structural working capital stress

What Changed Since Last Year?

In 2023–24, BYD attributed high AP to high material costs and production cycles. But by 2025:

- Material prices dropped

- Deliveries plateaued

- Capex slowed

Yet payables ballooned faster than COGS or inventory.

Theories Behind the Surge

1. BYD is stretching suppliers for free credit.

2. There’s an internal liquidity crunch.

3. Accounting sleight of hand may be masking true liabilities.

Risk to Investors and Creditors

Short-term liabilities exceed short-term assets by ¥110B. Supplier protest rumors are spreading. Moody’s issued a negative outlook warning in June.

What To Watch in H2 2025

- Q3 earnings and operating cash flow

- Supplier disclosures

- Audit footnotes

- Western regulatory scrutiny

Conclusion

While BYD leads in EV volume, its payables surge raises concerns about its financial structure. Investors should look past deliveries and scrutinize the company’s working capital health.